How To Register For Uk Vat

Everything you need to know about registering for VAT

VAT tin can exist intimidating for anyone who runs their own small business concern, especially those who are already struggling with paperwork and are unsure of HMRC's rules. Our guide explains what VAT is, how it affects your business and when yous need to register.

A quick introduction to VAT

VAT is short for 'Value Added Tax', and is charged on most sales of goods and services in the UK.

When your concern makes sales, y'all don't charge VAT to your customers unless you're registered with HMRC to do so. Sales on which VAT would normally be charged are called "taxable sales" or "VATable sales". Sales that are exempt from VAT, or exterior the scope of UK VAT, are not taxable sales.

You simply accept to annals your concern if its annual taxable sales are over the limit set by HMRC which is £85,000.

When do you need to register for VAT?

If your almanac taxable sales are in a higher place £85,000 per year - or they are set to pass that limit in the next thirty days - and then you must register for VAT. This is called compulsory registration.

In some cases you may wish to annals earlier yous reach the threshold. This is called voluntary registration and it tin aid your cashflow, because existence registered for VAT allows your business organization to claim back input VAT on its costs. However, if your customers are members of the general public or small businesses that aren't registered for VAT, it may not exist a adept idea to register voluntarily, as you would accept to charge your customers VAT which they wouldn't be able to claim back. This could result in many of your customers paying more for the same appurtenances or services.

How to register for VAT in the UK

Nearly people register for VAT online. If HMRC accepts your application for registration, they will send you a certificate which will as well bear witness your business organization's unique VAT reference number.

What happens afterwards you register?

Once your business is registered for VAT, then it has to accuse VAT on all the taxable sales it makes to its customers. The VAT you charge to your customers is called 'output VAT'. You lot can apply our VAT calculator to work out how much output VAT you should charge.

Your business organisation volition besides exist able to repossess some of the VAT that its suppliers charge. Carry in heed that in that location are some supplies on which you won't exist able to reclaim VAT, such as entertaining anyone other than staff. VAT that can exist reclaimed is chosen 'input VAT'.

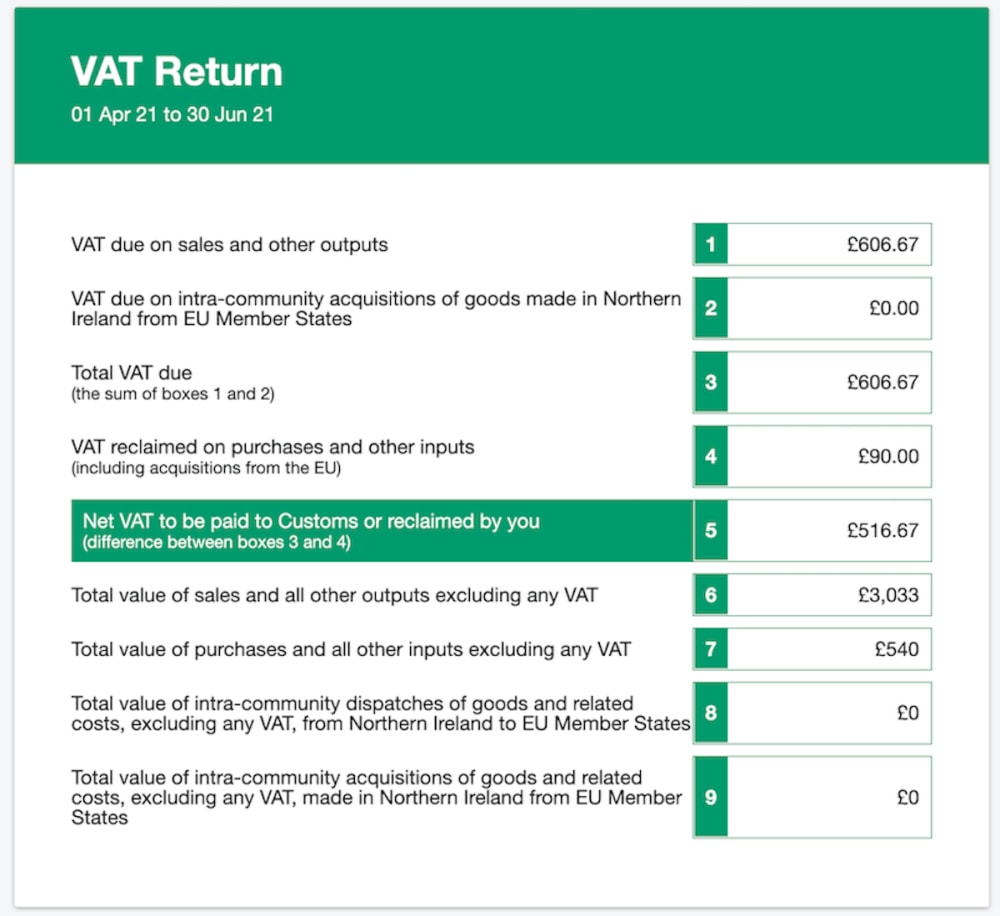

In society to declare how much output VAT you've charged and input VAT yous've reclaimed, you must file a regular VAT return to HMRC. Your VAT return shows your business organisation'southward output VAT minus its input VAT - and the difference is what you must pay to HMRC.

If your input VAT is greater than your output VAT, you lot'll get a refund from HMRC.

Filing your VAT return using FreeAgent

FreeAgent generates Making Tax Digital-compatible VAT returns automatically based on the bookkeeping data yous enter each quarter. When your VAT return is due, you can file information technology direct to HMRC from the software.

Find out more well-nigh VAT in FreeAgent

Managing the transition period

You employ to exist registered for VAT as from a certain date, so there will usually be an interim period between that engagement and the inflow of your certificate and VAT registration number. You'll have to charge output VAT on whatever sales after your registration date – but until your VAT registration number arrives, you lot won't be able to effect official VAT invoices. In the interim period y'all'll need to add the relevant rate of VAT - usually 20% - to the total value of all your invoices every bit from the date from which you've applied to be registered.

One time your VAT registration number comes through, you'll need to re-issue whatsoever invoices that you lot issued to your customers during the acting menstruation. This is and so that your customers have official VAT invoices and can reclaim input VAT on the appurtenances or services they've bought from you,

Remember that VAT can exist exceptionally confusing, so if you take any queries about VAT and how it affects your business, you should check with HMRC or speak to an accountant for more than advice.

Disclaimer: The content included in this guide is based on our agreement of tax law at the time of publication. It may be subject field to change and may not be applicative to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek contained advice if you require farther data nearly the content included in this guide. If you don't take an accountant, take a wait at our directory to find a FreeAgent Practise Partner based in your local area.

How To Register For Uk Vat,

Source: https://www.freeagent.com/guides/vat/registering/

Posted by: poorealiampat.blogspot.com

0 Response to "How To Register For Uk Vat"

Post a Comment